Healthcare is an essential sector, deeply embedded in global economies and individual lives, making it a critical area for long-term investment. With an ever-increasing demand for healthcare services driven by demographic shifts, technological innovation, and the rise of chronic diseases, the healthcare industry presents a robust opportunity for investors seeking long-term growth and stability.

In an era of rapid change, healthcare continues to evolve, supported by advancements in biotechnology, pharmaceuticals, medical devices, and healthcare services. Investors who understand the underlying factors driving the healthcare sector will find that it offers not only consistent returns but also resilience during economic downturns, making it one of the most attractive areas for long-term investment.

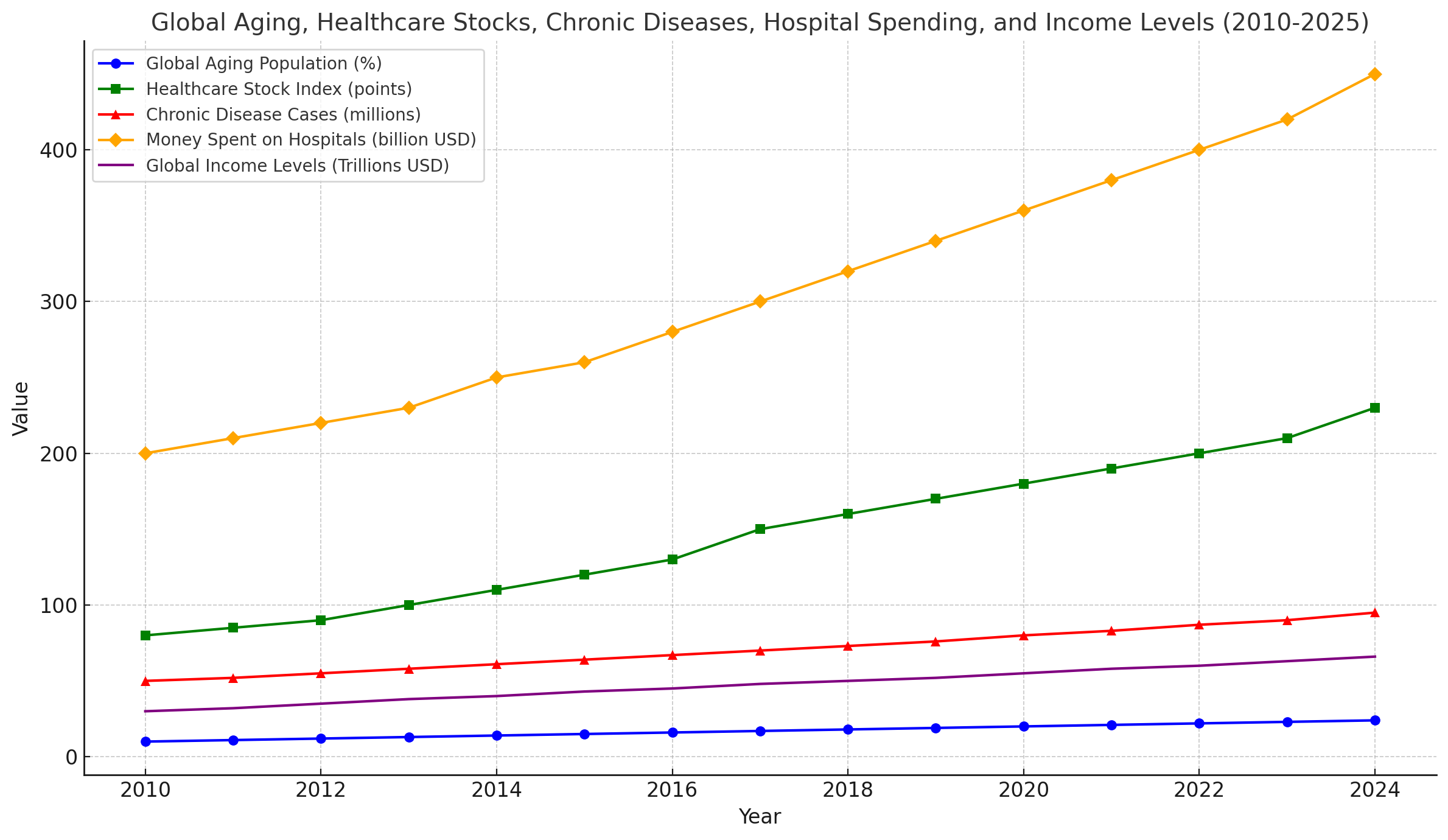

One of the most significant drivers of long-term growth in the healthcare sector is the aging global population. Countries around the world, particularly in developed markets such as the US, Europe, and Japan, are witnessing a dramatic rise in the number of elderly individuals. This demographic shift creates increasing demand for healthcare services, including preventive care, chronic disease management, and long-term care services.

The World Health Organization (WHO) projects that the global population aged 60 and over will double by 2050. This growing elderly population, combined with rising life expectancy, will result in increased healthcare spending as older adults require more frequent and intensive medical care. From pharmaceuticals and medical devices to assisted living facilities and home healthcare services, the aging population is creating new opportunities across the healthcare spectrum.

Moreover, emerging markets are experiencing similar trends as rising incomes lead to increased access to healthcare. The growth of the middle class in countries like China, India, and Brazil is expanding healthcare access to millions of people who previously had limited medical services, further driving global demand.

The prevalence of chronic diseases, such as diabetes, heart disease, cancer, and respiratory illnesses, is another powerful force behind the long-term demand for healthcare services. The rise of sedentary lifestyles, poor diets, and environmental factors has led to a global health crisis where chronic diseases account for a significant portion of healthcare spending.

Chronic diseases require ongoing treatment, regular medical consultations, and often, long-term management, making them a continuous source of demand for healthcare products and services. The pharmaceutical industry, in particular, has benefited from this trend, as new medications and therapies are developed to manage and treat these conditions.

In addition, the rise of mental health awareness and the growing need for mental health services, driven by increased stress, anxiety, and depression in modern societies, has added another dimension to healthcare demand. Investment in mental health services and pharmaceuticals targeting neurological conditions is expected to grow, offering additional opportunities in this evolving sector.

The healthcare sector is on the cusp of a technological revolution, with innovation driving growth and creating new investment opportunities. Biotechnology companies, in particular, are developing breakthrough therapies, such as gene editing, immunotherapies, and personalized medicine, that have the potential to transform how diseases are treated.

Technological advances are not limited to pharmaceuticals and biotech. Medical devices, diagnostics, and telemedicine have all benefited from technological progress. Devices such as wearable health monitors, artificial intelligence-driven diagnostic tools, and robotic surgery systems are improving patient outcomes while reducing costs and enhancing efficiency in healthcare delivery.

Investments in companies that are at the forefront of these innovations offer significant upside potential, as these technologies gain wider adoption. Healthcare-focused venture capital and private equity funds have been increasingly focused on biotech and med-tech startups, recognizing the potential for high returns as these companies grow and disrupt traditional healthcare models.

Healthcare is a defensive sector that tends to perform well during periods of economic uncertainty. Unlike cyclical sectors such as consumer discretionary or energy, healthcare is a necessity, and demand for healthcare services remains steady regardless of the broader economic environment. People will always require medical care, making healthcare a more stable and reliable investment, particularly during market downturns.

During periods of economic contraction or financial crises, healthcare companies typically experience less volatility in revenue and earnings compared to other industries. This resilience is one reason why healthcare stocks and funds are often considered "safe havens" in uncertain times. In addition, healthcare companies that offer essential products, such as pharmaceuticals, vaccines, and medical supplies, often benefit from government support and insurance coverage, further insulating them from economic shocks.

Another key area of investment opportunity within healthcare is healthcare services, including hospitals, outpatient care centers, and home healthcare. As the global population continues to age, there will be increased demand for healthcare infrastructure, such as new hospitals, diagnostic centers, and nursing facilities.

Healthcare real estate investment trusts (REITs) are one way for investors to gain exposure to this trend. These REITs invest in income-generating properties like senior housing, hospitals, and skilled nursing facilities, offering stable returns backed by long-term leases and high demand.

Additionally, the shift toward outpatient care and home-based healthcare is transforming the way healthcare is delivered, offering new opportunities for investors. Healthcare services companies that provide telehealth, remote patient monitoring, and home care services are well-positioned to benefit from this shift, as patients increasingly prefer more convenient and cost-effective care options.

Governments around the world continue to play a central role in the healthcare sector by providing funding, regulatory oversight, and policy initiatives that shape the industry. In developed markets, government healthcare spending represents a significant portion of total healthcare expenditures. Medicare, Medicaid, and other public health programs ensure a consistent flow of funds into the sector, providing a stable foundation for healthcare companies.

In emerging markets, governments are ramping up healthcare spending to expand access and improve the quality of care. Investments in healthcare infrastructure, disease prevention, and public health initiatives are creating opportunities for both domestic and international healthcare companies.

Institutional support also plays a significant role, with pension funds, endowments, and sovereign wealth funds increasingly allocating capital to healthcare investments. The long-term nature of healthcare investments aligns with the objectives of institutional investors seeking stable, inflation-resistant returns over time.

Healthcare offers a compelling long-term investment opportunity, driven by powerful demographic trends, technological innovation, and consistent demand for medical services. With aging populations, rising chronic diseases, and breakthroughs in medical technology, the sector is poised for sustained growth.

For investors, healthcare provides both stability and upside potential. The sector’s resilience during economic downturns, combined with its ability to capitalize on emerging trends in biotechnology, telemedicine, and healthcare services, makes it one of the most attractive areas for long-term investment. As global healthcare needs continue to expand, investors who allocate capital to healthcare will be well-positioned to benefit from this essential and evolving industry.