As we approach 2024, the global economy and financial markets are navigating an increasingly complex landscape. The interplay of economic recovery, inflation, geopolitical tensions, and technological advancements will shape market dynamics in the coming years. For investors and businesses, understanding these shifts and adjusting strategies accordingly will be essential for success.

The global economy continues to recover from the disruptions of the past few years, but the pace of recovery is uneven. Developed markets like the US and Europe are expected to experience moderate growth as central banks maintain tighter monetary policies to manage inflation. On the other hand, emerging markets, particularly in Asia and Latin America, are poised for stronger growth, driven by rising domestic demand and increased trade. These regions, including countries such as India and Brazil, are likely to be key drivers of global growth going forward.

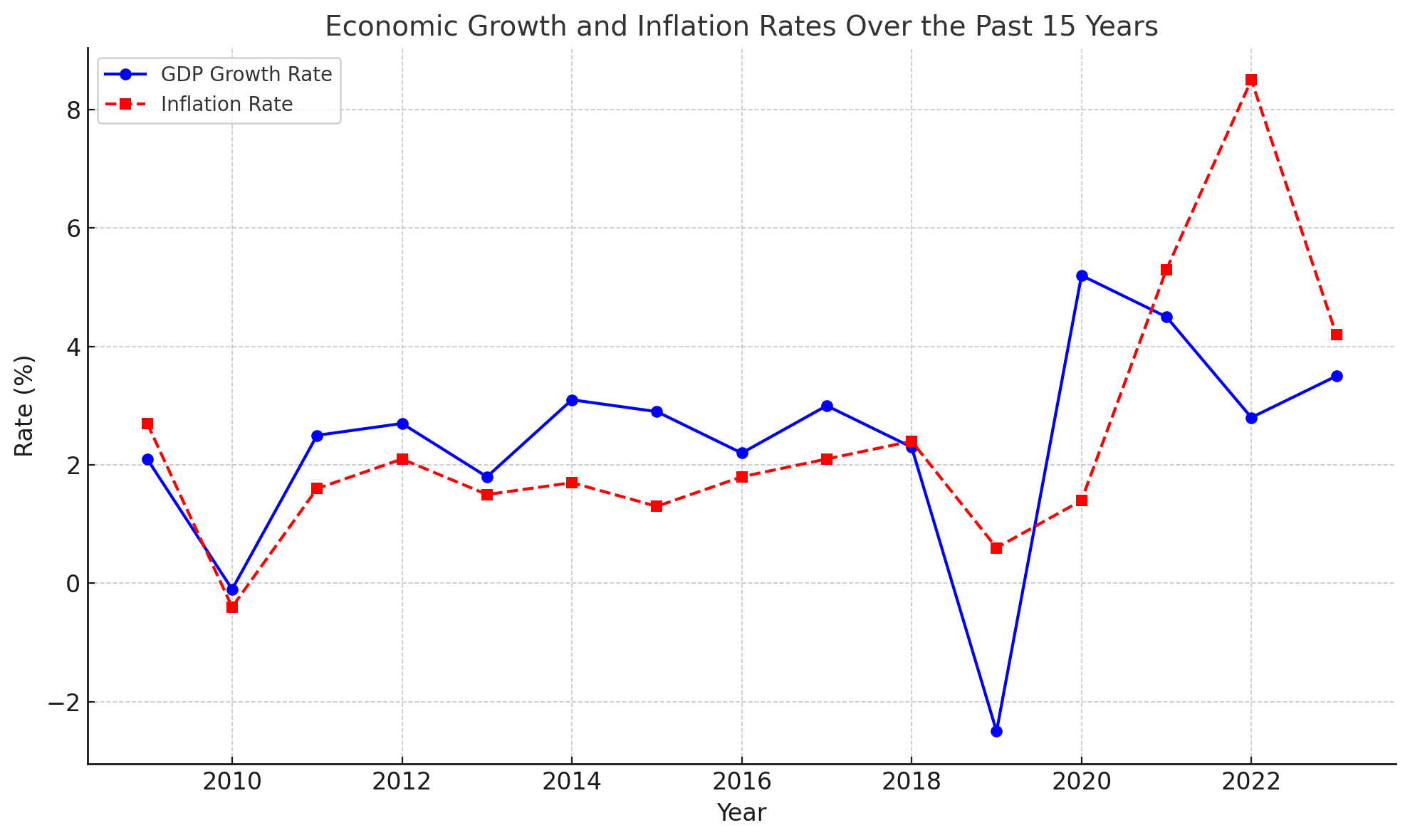

Inflation remains a central issue for 2024. While it has started to show signs of easing, inflation rates are still above target levels in many economies. Central banks, including the Federal Reserve and the European Central Bank, are expected to continue a cautious approach, likely keeping interest rates elevated to control inflation. However, if inflation subsides more rapidly than anticipated, we may see rate cuts that would provide relief to both businesses and consumers.

Inflation will also have a significant impact on markets. In equities, sectors like energy and commodities are expected to continue benefiting from inflationary pressures, as these industries are better positioned to pass rising costs onto consumers. Conversely, sectors like technology and consumer goods, which are more sensitive to inflation and rising input costs, may face headwinds. Fixed-income markets, particularly long-duration bonds, are likely to feel the pressure of elevated interest rates, pushing investors toward shorter-duration bonds and inflation-protected securities.

The technology sector, particularly advancements in artificial intelligence (AI), remains a major focus for 2024. AI integration across industries, from healthcare to finance, is set to accelerate, driving innovation and efficiency. Sectors that can harness AI effectively will likely see enhanced productivity and profitability. Additionally, cybersecurity will continue to be a critical area of investment as businesses and governments work to protect critical infrastructure from increasing cyber threats.

Energy, particularly renewable energy, will remain a prominent theme in 2024. The global shift towards clean energy is gaining momentum as governments and corporations push for sustainability and net-zero carbon targets. Companies involved in renewable energy infrastructure, electric vehicles, and energy storage are well-positioned for growth. However, traditional energy sources like oil and gas will still play a vital role, particularly in meeting short-term global energy demand. Investors can expect volatility in the energy sector, with opportunities for gains in both renewable and traditional energy markets.

Healthcare is another sector poised for significant growth. Biotechnology, pharmaceuticals, and medical devices are expected to see continued advancements, particularly in areas like gene therapy and personalized medicine. The telehealth market, which saw rapid expansion during the pandemic, will likely continue to grow as digital health solutions gain traction.

Geopolitical tensions will remain a key risk factor in 2024. Ongoing trade disputes, particularly between the US and China, may continue to disrupt global supply chains and impact international trade. Investors should be mindful of geopolitical flashpoints, particularly in regions like Eastern Europe and the Middle East, where conflicts can lead to market volatility and commodity price fluctuations.

Environmental, social, and governance (ESG) investing will continue to gain momentum. Investors are increasingly seeking companies that demonstrate strong ESG credentials, particularly those that are committed to sustainability and ethical governance. The global push for net-zero emissions is driving investments in green technologies and sustainable funds. ESG-focused investments are likely to outperform in the long term as both institutional and retail investors prioritize environmental responsibility and corporate transparency.

Emerging markets offer some of the most promising growth opportunities for 2024. Asia, particularly Southeast Asia and India, is set to drive global economic growth as industrialization and consumer demand rise. Latin America, particularly Brazil and Mexico, is also expected to rebound as inflation stabilizes and reforms improve the business environment. These regions, rich in natural resources and commodities, are poised to benefit from increased demand in energy and raw materials.

Given the uncertainties in global markets, investors should adopt strategies that balance growth and risk. Diversification across asset classes, sectors, and geographies will be key to managing market volatility. Inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), and real assets, such as real estate and commodities, offer ways to hedge against rising inflation. Dividend-paying stocks from companies with strong cash flows can also provide stable income streams, even in uncertain markets.

In conclusion, as we look ahead to 2024 and beyond, the global economy will continue to face a mixture of challenges and opportunities. Inflation, geopolitical risks, and shifting central bank policies will be key concerns, while technology innovation, sustainability trends, and growth in emerging markets present exciting opportunities for investors. By staying informed and adopting diversified, long-term investment strategies, investors can position themselves for success in an ever-evolving market landscape.