Over the past two decades, the mutual fund industry has experienced a remarkable and consistent growth trajectory, solidifying its position as a cornerstone of global investment strategies. From the early 2000s to 2024, mutual fund assets have surged, reflecting the increasing trust that individual investors and institutions alike place in these diversified investment vehicles. This article delves into the key drivers behind this growth and provides a professional analysis of the industry's sustained upward trend.

A 20-Year Snapshot: Unprecedented Growth

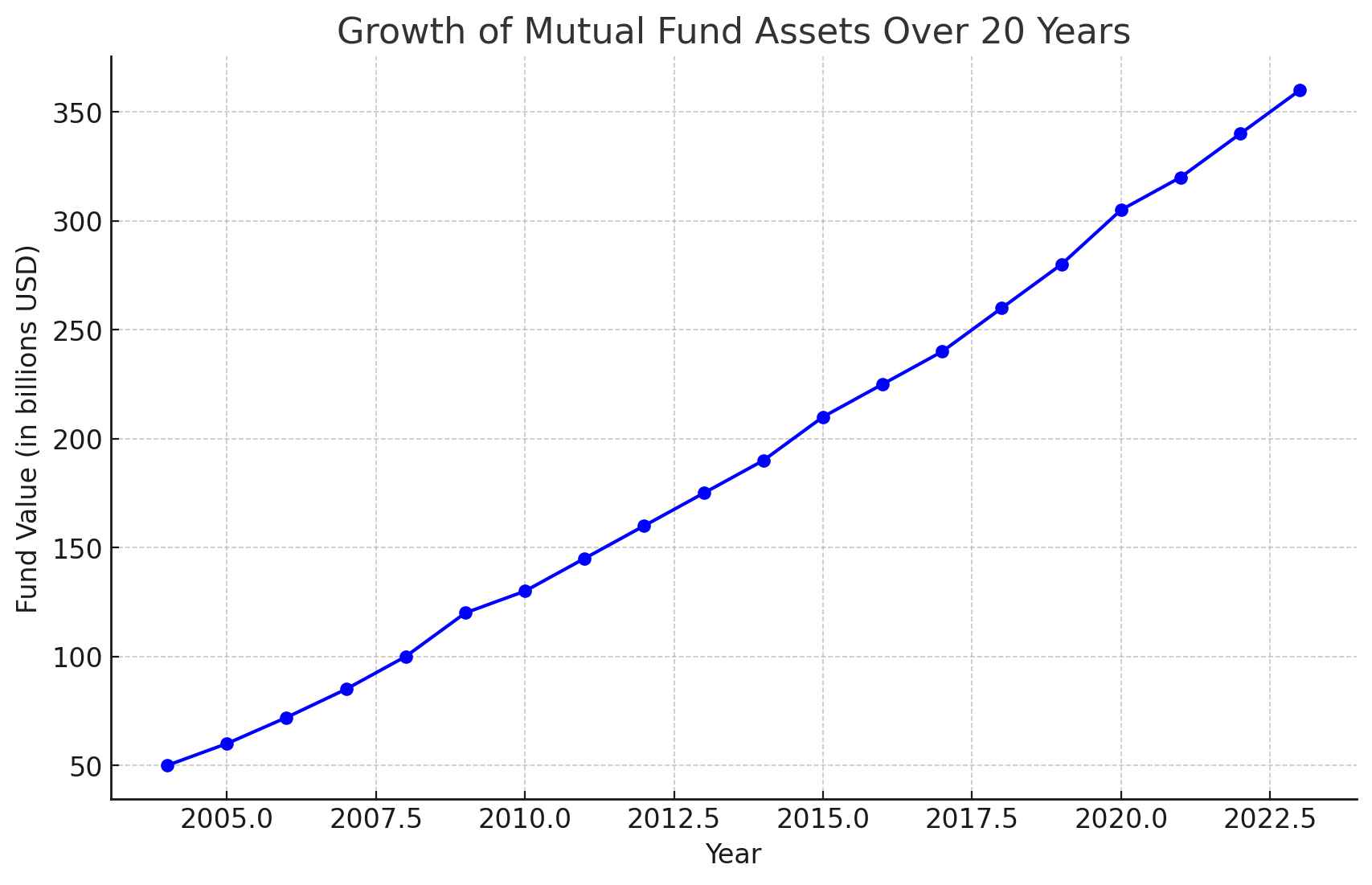

Between 2004 and 2024, mutual fund assets grew from an estimated $50 billion to a staggering $360 billion. This exponential growth represents a compound annual growth rate (CAGR) of approximately 8%, a testament to the enduring appeal of mutual funds as an investment option.

Several key factors contributed to this impressive rise:

-

Diversification and Risk Mitigation: Mutual funds offer a diversified portfolio across various asset classes, sectors, and geographies, reducing the risk associated with single-stock investments. This built-in risk management feature has continued to attract both novice and seasoned investors, especially during periods of market volatility.

-

Increased Investor Awareness: Over the years, financial literacy has significantly improved. Investors are now more educated about the benefits of long-term investment strategies, such as dollar-cost averaging and compounding interest, which mutual funds are well-positioned to capitalize on.

-

Technological Advancements: The rise of digital platforms and robo-advisors has made investing in mutual funds more accessible to the average individual. With just a few clicks, investors can now build diversified portfolios, increasing mutual fund participation rates across a broader demographic.

-

Regulatory Framework and Trust: In most regions, mutual funds are tightly regulated, providing transparency and protection for investors. This strong regulatory framework has instilled trust and confidence, encouraging more people to allocate their savings into mutual funds.

-

Low-Cost Investment Options: The development of index funds and exchange-traded funds (ETFs) has led to a new breed of mutual funds with lower fees, offering cost-effective solutions that attract cost-conscious investors. The ability to access a broad market portfolio at a fraction of the cost has made these products increasingly popular over the last two decades.

Professional Analysis: Why the Future Looks Bright

The consistent growth of mutual funds is not just a result of market conditions but also reflects deeper economic and behavioral shifts. Here are a few reasons why mutual funds are poised for continued growth:

-

Shifting Demographics: As the global middle class continues to expand, more households are gaining access to disposable income and are looking for secure, long-term investment options. Mutual funds, with their lower entry barriers, are perfectly positioned to capture this emerging market.

-

Pension and Retirement Planning: With the global workforce increasingly focusing on retirement planning, mutual funds have become a go-to vehicle for building retirement portfolios. Governments and employers are also encouraging the use of mutual funds in retirement accounts, such as 401(k)s and IRAs, further bolstering the industry's growth prospects.

-

Sustainable and ESG Investing: Another critical trend driving the mutual fund industry's future is the growing demand for Environmental, Social, and Governance (ESG) investing. Investors are increasingly seeking funds that align with their values, and mutual fund managers have responded by offering a range of socially responsible investment (SRI) products. This shift toward ethical investing is expected to continue fueling the sector’s growth.

-

Global Economic Integration: As global markets become more integrated, mutual funds that offer exposure to international markets have seen a surge in demand. Investors are now more inclined to diversify across geographies, tapping into emerging markets and benefiting from global growth trends. This cross-border diversification has helped sustain the growth of mutual fund assets, especially as global economies recover from recessions and financial crises.

Conclusion: A Stable Future for Mutual Funds

The mutual fund industry's growth over the past 20 years highlights its adaptability and resilience. By providing investors with diversified, professionally managed portfolios and accessible investment options, mutual funds have maintained their appeal across all market cycles. As more investors continue to prioritize long-term financial planning and sustainability, the mutual fund industry is well-positioned for sustained growth in the coming decades.

As we look ahead, mutual funds remain one of the most reliable and effective tools for wealth creation, allowing investors of all sizes to participate in the broader economic success while mitigating risk through diversification. The future of mutual funds appears brighter than ever, offering endless opportunities for individual and institutional investors alike.